|

|

| (9 intermediate revisions by 4 users not shown) |

| Line 12: |

Line 12: |

| | = Financial Instruments = | | = Financial Instruments = |

| | | | |

| − | There are various types of financing instruments that exist to support the scaling up of '''renewable energy technologies (<span data-scaytid="3" data-scayt_word="RETs">RETs</span>)'''. The choice and availability of instruments largely depends on if the project is being undertaken in a developed or developing country, and also on the stage of development of the technologies or projects in question. These can be broadly grouped into those that can be used in addressing financing barriers; those used to address the risks of RET investments; and those that address both simultaneously.<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy</ref> | + | There are various types of financing instruments that exist to support the scaling up of '''renewable energy technologies (<span data-scayt_word="RETs" data-scaytid="3">RETs</span>)'''. The choice and availability of instruments largely depends on if the project is being undertaken in a developed or developing country, and also on the stage of development of the technologies or projects in question. These can be broadly grouped into those that can be used in addressing financing barriers; those used to address the risks of RET investments; and those that address both simultaneously.<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy</ref> |

| | | | |

| | These financial instruments can be distinguished by the level of risk assumed by the the entity funding the instrument concerned, and also by the level of leverage involved. The figure below illustrates this. The financial instruments in the figure are organised on the horizontal axis by their primary focus: whether to address underdeveloped financial markets, the risks and costs of RETs or both. The vertical axis organises the instruments by the level of risk and leverage associated with their use <ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy</ref> | | These financial instruments can be distinguished by the level of risk assumed by the the entity funding the instrument concerned, and also by the level of leverage involved. The figure below illustrates this. The financial instruments in the figure are organised on the horizontal axis by their primary focus: whether to address underdeveloped financial markets, the risks and costs of RETs or both. The vertical axis organises the instruments by the level of risk and leverage associated with their use <ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy</ref> |

| − | <div class="page" title="Page 21"><div class="layoutArea"><div class="column"> | + | <div title="Page 21" class="page"><div class="layoutArea"><div class="column"> |

| | <br/> | | <br/> |

| | | | |

| Line 24: |

Line 24: |

| | = On-Grid Renewable Energy Finance = | | = On-Grid Renewable Energy Finance = |

| | | | |

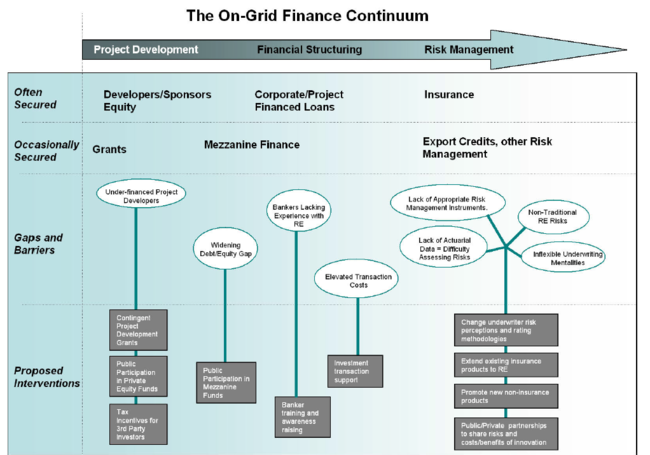

| − | On-grid renewables projects face the key issue of how to create a price support mechanism that provides stability and predictability over the medium and long term. This can reduce the risk premium in the cost of capital, which in turn can increase the amount of investment in renewables and lower the price that consumers have to pay for RE. <span style="font-size: 0.85em;">For on-grid projects the finance sequence is incomplete, and these gaps can often onl be filled with niche financial products. Some of theses products already exist, while some need to be created. The figure below shows which types of finance are often secured by on-grid projects, which types are occassionaly secured, and the current gaps and barriers in the finance sequence <ref name="Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.">Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.</ref>.</span> | + | On-grid renewables projects face the key issue of how to create a price support mechanism that provides stability and predictability over the medium and long term. This can reduce the risk premium in the cost of capital, which in turn can increase the amount of investment in renewables and lower the price that consumers have to pay for RE. <span style="font-size: 0.85em">For on-grid projects the finance sequence is incomplete, and these gaps can often onl be filled with niche financial products. Some of theses products already exist, while some need to be created. The figure below shows which types of finance are often secured by on-grid projects, which types are occassionaly secured, and the current gaps and barriers in the finance sequence <ref name="Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.">Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.</ref>.</span> |

| | | | |

| | <br/> | | <br/> |

| | | | |

| − | Various forms of capital are involved in the financial sequence/'continuum' of grid-connected RETs as shown in the figure below. The conventional power sector financial sequence includes these sources of capital: | + | Various forms of capital are involved in the financial sequence/'continuum' of grid-connected RETs as shown in the figure below. <u>The conventional power sector financial sequence includes these sources of capital:</u> |

| | *Equity Finance | | *Equity Finance |

| | + | *Debt Finance |

| | *Corporate or Project Finance | | *Corporate or Project Finance |

| | *Guarantees | | *Guarantees |

| − | *Insurance | + | *Insurance<ref name="Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.">Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.</ref><span style="line-height: 1.5em; font-size: 0.85em">.</span> |

| − | *Key parties to the transaction, such as fuel suppliers or power purchasers who have entered into long-term contracts with the project<ref name="Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.">Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.</ref>.

| |

| | | | |

| | <br/> | | <br/> |

| | | | |

| | [[File:On-Grid RE Financing.PNG|thumb|center|650px|Source: Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.]] | | [[File:On-Grid RE Financing.PNG|thumb|center|650px|Source: Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.]] |

| | + | |

| | + | <br/> |

| | | | |

| | <br/> | | <br/> |

| Line 43: |

Line 45: |

| | == Equity Finance == | | == Equity Finance == |

| | | | |

| − | RE equity investments involve investments by a range of financial investors including Private Equity Funds, Infrastructure Funds and Pension Funds, into companies or directly into projects or portfolios of assets.<br/>

| + | <span style="background-color: rgb(255, 255, 255)"></span>[[Equity Finance|► Read about Equity Finance here]]<br/> |

| − | | |

| − | Different types of equity investors will engage depending on the type of business, the stage of development of the RET and the risk associated with it (See the table below for more information). For instance:

| |

| − | *Venture Capital is focused on 'early stage' technology companies

| |

| − | *Private Equity firms focus on later stage financing of more mature technologies or projects. They generally expect to exit their investment and make returns in 3-5 year.

| |

| − | *Infrastructure Funds are interested in lower risk infrastrucure such as roads, rail, grid, waste facilities etc, which tend to have a longer term investment horizon and thus expect lower returns over their period.

| |

| − | *Institutional Investors such as Pension Funds have an even longer time horizon and larger amounts of money to invest. They have a lower risk appetite<ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009.">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref>.

| |

| | | | |

| | <br/> | | <br/> |

| | | | |

| − | Funds use Internal Rate of Return (IRR, or ‘rate of return’) of each potential project as a key tool in reaching investment decisions. It is used to measure and compare the profitability of investments. Funds will generally have an expectation of what IRR they need to achieve, known as a hurdle rate. The IRR can be said to be the earnings from an investment, in the form of an annual rate of interest<ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009.">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref>.<br/>

| + | == Debt Finance == |

| | | | |

| | + | <span style="background-color: rgb(255, 255, 255)">[[Debt Finance|► Read about Debt Finance here]]</span> |

| | + | <div><div title="Page 36" class="page"><div class="layoutArea"></div></div></div> |

| | <br/> | | <br/> |

| | | | |

| − | {| cellspacing="1" cellpadding="5" style="width: 100%;"

| + | == <span style="font-size: 19.09090805053711px; line-height: 23.636363983154297px">Project Finance</span> == |

| − | |-

| |

| − | | colspan="2" style="background-color: rgb(79, 129, 189); text-align: center;" | <span style="color:#ffffff;">'''Features of Funds Providing Equity'''</span>

| |

| − | |-

| |

| − | | style="background-color: rgb(219, 229, 241);" | '''Venture Capital Funds'''

| |

| − | |

| |

| − | *Money raised from a wide range of sources with high risk appetite to include insurance companies, mutual funds, high net worth individuals

| |

| − | *Target new technology, new markets

| |

| − | *Interested in early-stage companies

| |

| − | *High risk of failure in every venture

| |

| − | *Investment horizon around 4-7 years

| |

| − | *Return requirement, many multiples of original investment (50 – 500% IRR)

| |

| | | | |

| − | |-

| + | <span style="background-color: rgb(255, 255, 255)">[[Project Finance|► Read about Project Finance here]]</span> |

| − | | style="background-color: rgb(219, 229, 241);" | '''Private Equity Funds'''

| |

| − | |

| |

| − | *Money raised from a wide range of sources with medium risk appetite to include institutional investors and high net worth individuals

| |

| − | *Target opportunities with possibility for enhanced returns (or‘upside’)

| |

| − | *Interested in companies and projects with more mature technology, including those <span style="line-height: 1.5em;">preparing to raise capital on public stock exchanges (‘pre IPO’), demonstrator </span><span style="line-height: 1.5em;">companies, or under-performing public companies.</span>

| |

| − | *Shorter investment horizon, 3-5 years

| |

| − | *Higher return requirement, 25% IRR

| |

| | | | |

| − | |-

| + | <br/> |

| − | | style="background-color: rgb(219, 229, 241);" | '''Infrastructure Funds'''

| |

| − | |

| |

| − | *Funds drawn from a range of institutional investors and pension funds

| |

| − | *Target ‘infrastructure’ i.e. an essential asset, long duration, steady low risk cash flow<br/>

| |

| − | *Interested in roads, railways, power generating facilities

| |

| − | *Medium term investment 7-10 years

| |

| − | *Low risk and return, 15 % IRR

| |

| | | | |

| − | |-

| + | == Guarantees == |

| − | | style="background-color: rgb(219, 229, 241);" | '''Pension Funds'''

| |

| − | |

| |

| − | *Typical investments include:<br/>- Public equity (via stock markets)<br/>- Corporate and government bonds<br/>- Real estate<br/>- Inflation-linked assets (such as commodities, inflation linked bonds, infrastructure and energy, forest land)<br/>- Private equity<br/>- Cash and cash equivalents<br/>

| |

| − | *Investing directly they seek ‘cash yielding’ investments, i.e. those that generate a stream of cash year on year, as opposed to an investment in which all cash is realised at the end of the investment period through an ‘exit’ (by either sale or IPO). These investments are required to support their long term liabilities;<br/>

| |

| − | *<span style="line-height: 1.5em;">For these investments they display a low risk appetite, reflected in expectations of stable returns at around the 15% level;</span><br/>

| |

| − | *<span style="line-height: 1.5em;"></span><span style="line-height: 1.5em;">In RE they make very low risk investments e.g. a portfolio of operational onshore wind assets;</span><br/>

| |

| − | *<span style="line-height: 1.5em;"></span><span style="line-height: 1.5em;">As they have very large funds to invest, they do not commonly get involved in individual projects.They may allocate monies to specialised Private Equity or Venture Capital funds (including infrastructure or renewable energy funds) that manage the investments and provide the pension funds with a return;</span><br/>

| |

| − | *<span style="line-height: 1.5em;"></span><span style="line-height: 1.5em;">A </span><span style="line-height: 1.5em;">handful of specialised RE bonds have been issued which have been of interest to pension funds. Risks are described in the project bond issue documents. Project risks will be extensively mitigated (such as reserve facilities, for example for maintenance problems, distribution restrictions, cash sweeps) in order for the project to attract “an investment grade rating” making it attractive to investors (a higher rating suggests less risk that the project will default on its bond obligations leaving bond investors at risk of not being repaid).</span>

| |

| | | | |

| − | |-

| + | <br/> |

| − | | colspan="2" | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px;">Source: </span><span style="font-size: 12px; line-height: 18px;">Adapted from <ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009.">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref></span>''

| |

| − | |}

| |

| | | | |

| | <br/> | | <br/> |

| | | | |

| − | == Project Finance == | + | == Insurance == |

| | | | |

| − | Project Finance is debt that is borrowed for a specific project. The amount of debt made available is linked to the revenue that the project will generate over a period of time, as this is the means of paying back the debt. This amount is usually adjusted to refelct inherent risks such as the production and sale of power. Should there be a problem with repaying the loan, the banks will establish firts 'charge' or claim over the assets of a business. The first tranche of debt to be repaid from a project is called 'senior debt' and is described in detail below.<ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. ">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref>

| + | <br/> |

| − | | |

| − | Usually, project preparation for on-grid RE projects is carried out by large energy companies or specialised project-development companies. Energy companies finance the project preparation phase from operational budgets. On the other hand, specialised companies finance this phase through private finance, capital markets or with risk capital from venture capitalists, private equity funds, or strategic investors.

| |

| | | | |

| | <br/> | | <br/> |

| | | | |

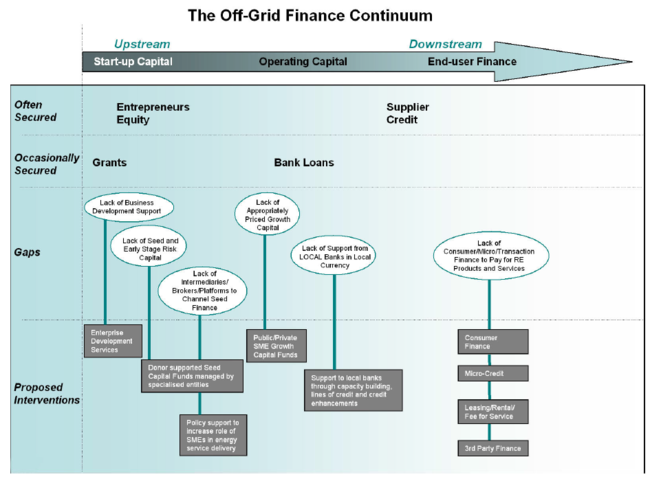

| − | == Debt Financing == | + | = Off-Grid Renewable Energy Finance = |

| | | | |

| − | Debt financing comes in the form of loans and requires the <span style="line-height: 1.5em; font-size: 0.85em;">repayment of both the principal sum borrowed and interest charged on that principal. Generally financial institutions will only provide debt finance to projects and project developers once the market is mature and therefore often need encouragement to enter the market. Debt finance can be provided to local finance institutions to allow them to on-lend to consumers, to project developers, or debt can be provided directly to a project developer. The debt must be repaid whatever the outcome of the project</span><ref name="Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.">Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.</ref><span style="font-size: 0.85em; line-height: 1.5em;">.</span>

| + | <br/> |

| | | | |

| − | International funds dedicated to development projects such as are provided by Multilateral Development Banks (MDBs) will often create loans with generous repayment terms, low interest rates and flexible time-frames, such loans are called "soft-loans"<ref name="Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.">Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.</ref>.<br/>Investment and commercial banks can lend money against the assets of the project. In the event of defaulting on the loan the bank can have no other claims other than the assets of the project. This type of financing is based on long-term commercial loan contracts<ref name="Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.">Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.</ref>.

| + | [[File:Off-grid RE Financing.PNG|thumb|center|650px|Source: Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.]]<br/> |

| | | | |

| | <br/> | | <br/> |

| | | | |

| − | === Senior Debt === | + | = Results-Based Finance = |

| | | | |

| − | Senior debt provided from public sources, takes its place among the first creditors to be repaid from a project. It is primarily used to reduce the costs of the project, by providing concessionary funds that may be blended with more expensive commercial funding, and to offer longer-term debt than may be available in local financial markets. Long-term loans from public sources can also help establish credibility among private financiers for longer-term lending to RE projects. A wide variety of debt amortization and repayment schedules can be used, allowing tailoring of debt service costs to project cash flows. For example, a bullet (one-off) repayment of the loan principal may be made at the end of the loan term, reducing debt service costs in the initial years of the project<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref>.<br/>A distinction can be made between direct loans to project companies and the provision of credit lines extended through commercial financing in- stitutions (CFIs) or other intermediaries. Credit lines can create incentives for intermediaries to extend their own loans to RET projects along- side that funded from the credit line as well as allowing blending of commercial and conces- sionary loans to reduce overall costs. The choice of intermediaries is discussed in chapter<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref>.

| + | [[Results-Based Financing|► Read about Results-Based Finance here]]<br/> |

| | | | |

| | <br/> | | <br/> |

| | | | |

| − | {| border="0" cellspacing="1" cellpadding="5" style="font-size: 13.63636302947998px; width: 1298.1817626953125px;"

| + | = Microfinance = |

| − | |-

| |

| − | | colspan="3" style="text-align: center; background-color: rgb(79, 129, 189);" | <font color="#ffffff"><span style="line-height: 20.39583396911621px;">'''Senior Debt'''</span></font>

| |

| − | |-

| |

| − | | style="background-color: rgb(219, 229, 241); text-align: center;" | '''Uses'''

| |

| − | | style="background-color: rgb(219, 229, 241); text-align: center;" | '''Advantages'''

| |

| − | | style="background-color: rgb(219, 229, 241); text-align: center;" | '''Disadvantages'''

| |

| − | |-

| |

| − | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"><div class="page" title="Page 25"><div class="layoutArea">

| |

| − | *Reduces project costs.<br/>

| |

| − | *Provides long-term finance.

| |

| − | </div></div></div></div></div>

| |

| − | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column">

| |

| − | *Obligation to repay creates incentives for project viability.<br/>

| |

| − | *<span style="line-height: 1.5em;">Repayment of principal frees funds for further support to RET projects.</span><br/>

| |

| − | *<span style="line-height: 1.5em;"></span>Used as a means to increase CFI involve- ment in RET projects (through provision as credit lines).

| |

| − | </div></div></div>

| |

| − | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column">

| |

| − | *Need for due diligence to verify ability of project to repay loan increases transaction costs.<br/>

| |

| − | *<span style="line-height: 1.5em;">Leverage is limited and may crowd out potential private providers of debt.</span>

| |

| − | </div></div></div>

| |

| − | |-

| |

| − | | colspan="3" |

| |

| − | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px;">Source: </span><span style="font-size: 10.909090995788574px; line-height: 18px;">Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds</span>''<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref>

| |

| | | | |

| − | |} | + | [[Microfinance|► Read about Microfinance here]]<br/> |

| | | | |

| − | <br/>

| |

| − | <div><div class="page" title="Page 36"><div class="layoutArea"></div></div></div>

| |

| | <br/> | | <br/> |

| | | | |

| − | == Subordinated Debt/Mezzanine Finance == | + | = Carbon Finance = |

| | | | |

| − | This type of lending sits between the top level of senior bank debt and the equity ownership of a project or company. Mezzanine loans take more risk than senior debt because regular repayments of the mezzanine loan are made after those for senior debt, however, the risk is less than equity ownership in the company. Mezzanine loans are usually of shorter duration and more expensive for borrowers, but pays a greater return to the lender (mezzanine debt may be provided by a bank or other financial institution). A RE project can seek mezzanine finance if the amount of bank debt it can access is insufficient: the mezzanine loan may be a cheaper way of replacing some of the additional equity that would be needed in that situation, and therefore can improve the cost of overall finance (and thus the rate of return for owners) <ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. ">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref>.

| + | [[Carbon Finance|► Read about Carbon Finance here]]<br/> |

| | | | |

| | <br/> | | <br/> |

| − | <div class="page" title="Page 36"><div class="layoutArea"><div class="column">

| |

| − | {| border="0" cellspacing="1" cellpadding="5" style="font-size: 13.63636302947998px; width: 100%;"

| |

| − | |-

| |

| − | | colspan="3" style="text-align: center; background-color: rgb(79, 129, 189);" | <font color="#ffffff"><span style="line-height: 20.39583396911621px;">'''Subordinated Debt / Mezzanine Finance'''</span></font>

| |

| − | |-

| |

| − | | style="background-color: rgb(219, 229, 241); text-align: center;" | '''Uses'''

| |

| − | | style="background-color: rgb(219, 229, 241); text-align: center;" | '''Advantages'''

| |

| − | | style="background-color: rgb(219, 229, 241); text-align: center;" | '''Disadvantages'''

| |

| − | |-

| |

| − | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"><div class="page" title="Page 25"><div class="layoutArea">

| |

| − | *<span style="font-size: 9pt; line-height: 1.5em;">Provides intermediate funding between equity and senior debt, which helps reduce risks to senior lenders while not taking control away from project sponsors.</span><br/>

| |

| − | *<span style="font-size: 9pt; line-height: 1.5em;"></span><span style="font-size: 9pt; line-height: 1.5em;">By doing so, can extend the term and reduce costs of senior debt.</span><span style="font-size: 9pt; line-height: 1.5em;"></span><br/>

| |

| − | </div></div></div></div></div>

| |

| − | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column">

| |

| − | *High level of leverage.<br/>

| |

| − | *<span style="line-height: 1.5em;">Crowds in senior debt by allowing projects to meet acceptable risk criteria for lenders.</span>

| |

| − | </div></div></div>

| |

| − | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column">

| |

| − | *It is generally custom designed for each project, implying high transaction costs.<br/>

| |

| − | *<span style="line-height: 1.5em;">Significant risk transferred to public financ- ing agencies, but with only limited ability to control these risks.</span>

| |

| − | </div></div></div>

| |

| − | |-

| |

| − | | colspan="3" |

| |

| − | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px;">Source: </span><span style="font-size: 10.909090995788574px; line-height: 18px;">Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds</span>''<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref><br/>

| |

| | | | |

| − | |}

| |

| − | </div></div></div>

| |

| − | <br/>

| |

| − | <div><div class="page" title="Page 36"><div class="layoutArea"></div></div></div>

| |

| − | <br/>

| |

| | | | |

| − | = Off-Grid Renewable Energy Finance = | + | = Further Information = |

| | | | |

| − | [[File:Off-grid RE Financing.PNG|thumb|center|650px|Source: Sonntag-O’Brien, V., Basel Agency for Sustainable Energy, Usher, E. & UN Environment Programme, 2004. Mobilising Finance for Renewable Energies - Thematic Background Paper, International Conference for Renewable Energies. Bonn, Renewables 2004.]]<br/> | + | *[[Revolving Funds|Revolving Funds]] |

| | | | |

| − | <br/>

| |

| | | | |

| | <br/> | | <br/> |

| | | | |

| − | = Further Information =

| |

| − |

| |

| − | *[https://energypedia.info/Revolving Funds Revolving Funds]

| |

| − |

| |

| − | <br/>

| |

| | | | |

| | = References = | | = References = |

![Source: The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. [Online] Available at: https://www.climateinvestmentfunds.org/cif/sites/climateinvestmentfunds.org/files/SREP_financing_instruments_sk_clean2_FINAL_FOR_PRINTING.pdf](/images/thumb/0/0e/RE_Financial_Instruments.PNG/650px-RE_Financial_Instruments.PNG)