Business Models for the Energy-Agriculture Nexus

Background

This article aims to provide you with basic knowledge on business models and common methods for business decision making (capital budgeting). Business models thereby do not necessarily refer to a complete new business but also apply to changes within an existing business e.g. introducing energy efficiency measures in a food processing company.

You also can check out the video lecture on energy efficiency by Prof. Ramchandra Bhandari, TH Köln – University of Applied Sciences:

Further information on the mentioned MOOC: Powering Agriculture – Sustainable Energy for Food and related materials you can find here.

Introduction to Business Models

Although the business model is a fundamental part of an economic activity, the term is understood and defined in many different ways. To put it simple, a business model describes the core strategy of an organization for how to generate money and by this determines how the company produces, distributes prices and promotes its products.

Usually all starts with an idea about how to earn money. Ideas might expand further on how to improve livelihood. The crucial point is about offering a product or a service that does not yet exist in the market, but that has a high potential to create value for people who will be willing to pay for the product or service. This idea should be commercially viable and sustainable. It should be noted that also established businesses develop new business models; for instance, optimizing a core process affects the business model. An example is improved energy access e.g. for a dairy collection center that is now able to cool the milk and thereby increase the added-value. For developing a new business or a start-up into a long-term successful business, it requires a well-defined business model. One helpful tool for this is the Business Model Canvas template which describes nine basic elements forming a business model. By answering the questions for each key point provided in Table 1 you can specify your individual business model. This is an important step before conducting financial calculations or starting to implement any business activity.

|

Customer Segments |

Who are your target customers? How big is the potential customer group? How is their willingness to pay for this product/service? |

|

Customer Relationship |

Which type of relationship should exist between you and the customers? Are any costs connected with this? |

|

Channels |

Which channels do you want to communicate and deliver to the customers? Which channels exist, are suitable and cost-efficient? |

|

Offer |

What do you want to offer to your customers? What kind of service or product? Which of their problems or needs are you addressing? |

|

Key Resources |

Which resources do you need for the production, marketing, cultivating the customer relations, etc.? |

|

Key Activities |

Which activities are necessary for the production, marketing, cultivating the customer relations, etc.? |

|

Key Partners |

Who are your main partners and suppliers? |

|

Cost Structure |

Which fixed and variable costs have to be considered? |

|

Revenue streams |

What are customers willing to pay for?How much do they pay for alternatives? |

To be able to answer these questions, it is recommended to carry out market research and analysis. Talk to people who do similar business and ask them to share their experiences. Talk to potential clients and find out what they think about your business idea, and what additional services or product features they would value. The market analysis also includes identifying competitors and characteristics of potential customers, including their willingness to pay. In addition, you have to figure out at what cost you can produce and what profit margin can be reached by selling the product or service.

Different kinds of business models exist around the world, and new and innovative ones are being developed continuously, interdependent with market demand and companies’ attempts to increase their competitiveness. There is not a single model that fits all kind of businesses. You have to define your own model that specifically fits to your intended economic activity.

An energy project can be the basis for your business and you have to develop the business model according to it. This will of course affect your economic calculations. With the help of specific economic methods that will be explained in this document, you can analyze if such a clean energy solution is profitable for your agribusiness, considering the costs as well as productivity gains.

Definition of Financial Terms

The following table contains brief definitions of relevant terms that commonly occur when talking about business models.

|

Direct Cost |

Costs that are directly related with the production of a particular service or good, e.g. material. |

|

Indirect Cost |

Costs that arise but cannot be assigned to a particular produced good or service. They are necessary for keeping the business running. Examples are electricity, rent for buildings, plant maintenance, administration, etc. |

|

Opportunity Cost |

Costs for the next best alternative that has to be given up in order to take the desired action. You could have used your resource (for example land, money) for something else and could have made profit with it. |

|

Capital Cost |

This is the one-time expense for setting up a plant or project. For example, capital costs include purchasing land, buildings, machinery, and administrative expenses (e.g. for permits). They can be paid by equity or by taking a loan from a financial institution. Latter result in cost of debt. This means that an interest is added to the loan and has to be paid back in addition to the borrowed amount of money (see “Interest rate”). |

|

Interest rate / Interest |

It is basically the cost for borrowing money. This rate is usually given as an annual percentage of the total amount of the loan. For example, if you take a loan of 1000 € a tan annual interest rate of 10%, then you have to pay 1100 € at the end of the year. Consequently, the pure interest would be 100 €. If you borrow the 1000 € for 5 years, this means the simple interest is: 1000 € * 10% * 5 = 500 €. |

|

Profit |

Profit = Total revenue – Total costs. Profits can be further divided into before and after tax profit. |

|

Revenue |

This is the income earned by a business typically through selling services or goods. Revenue= Quantity of items sold * Retail price |

|

Cash Flow |

Incoming and outgoing cash of a business. Costs are considered as negative cash flows and revenues as positive ones. Cash flow of one period = Benefits of the period – Costs of the period |

|

Discount Rate |

This rate is generally used to bring future costs or revenues to their market value at the present time. It expresses the time value of money. It is an indicator for the riskiness of an investment. |

The general way for a financial analysis is at first to define the total costs and to determine the total revenues. Subsequently, you need to apply one or even more methods of capital budgeting. Additionally, you should answer the questions of Table 1 to come up with a concrete business model. Before discussing the capital budgeting, take a look at the following simplified definitions [HCC, 2009]:

- Cost = anything that decreases your business profit

- Benefit = anything that increases your business profit

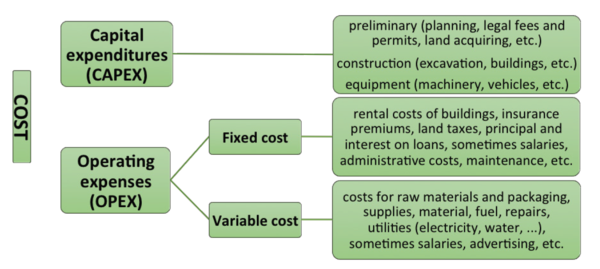

As calculating the costs can be a quite complex issue, the following illustration shows the distribution of cost types that can be divided into two main groups called Capital expenditures (CAPEX) and Operating expenses (OPEX).

Common Methods of Capital Budgeting

Making a decision on an investment of capital can be difficult, especially if a high investment is required, if it is a long-term investment, or if several investment alternatives are available. But using Capital Budgeting can support you in the decision process as it gives you an overview about the eventual returns on investments. By this you will know if the investment will provide a profit after a certain period of time. Further, it helps you identifying the most profitable investment options.

There are two principal approaches for assessing the profitability of investment projects: the static and the dynamic approach. Both are subdivided into several methods. In the following, the most common methods will be presented. All of them can be used for comparing several investment options as well as for assessing one individual investment.

Static Approach

This approach is recommendable for getting a first, quick overview about investment options and / or when looking at very short periods between occurring cash flows.

The profitability indicator PaybackTime (PBT) enables a comparison of different investment options, as well as an evaluation of the risk of an investment. In general, the investment option with the shortest payback period is the most favorable one. The method for calculating the payback period differs based on the type of annual repayments.

This method is useful for a first impression about investment options, as well as for ranking different investment options. However, you should not base your investment decision only on the result of the payback time method since it does not include cash flows after the payback period. Also, it does not consider the value of cash flows over time. It is highly recommended to further assess promising investment options by using methods of the Dynamic Approach.

Dynamic Approach

An important point to consider especially for long-term investments is the time value of money (TVM), meaning that the value of money changes with time. In simple terms, one Euro today is worth more than one Euro tomorrow. The argument being that the money could be invested and generate interest. This aspect is considered by the dynamic approach [Rudolf, 2008]. Consequently, future payments and revenues have to be discounted if they occur after the base year (in which the initial investment is realized) to receive the present time value. Therefore, the future cash flows have to be multiplied by the so-called discount factor (d) which depends on the discount rate (r) (equaling the rate for an alternative investment) as well as on the time difference between the cash flow occurring and the base year.

- The Net Present Value (NVP) transforms all future cash flows to their present value to enable a comparison of different investments

- The Internal Rate of Return (IRR) gives you an answer to the question on how much you get in return for your investment in the project.

To sum up, all of the presented investment assessment methods have their strengths and weaknesses. To receive reliable results on which one can base investment decisions, it is advisable to apply at least two of the explained methods for the calculations of your investment (options). However, the NPV is always a good choice to reduce the risk of losing money.

Microfinance

If you do not have enough money for purchasing e.g. a solar powered irrigation system, a biogas plant or for paying the capital cost, financial services of microfinancing are an option. Microfinance includes diverse services such as insurance, leasing, savings, cash transfer and credits; provided by microfinance institutes (MFI) that can be NGOs, banks, credit and savings cooperatives and associations. Their target groups are generally low-income households and small businesses who normally would not be offered a credit from a traditional bank due to the lack of guarantees or higher administrative expenses. A microcredit, meaning a small loan, is one of the provided instruments. Sometimes special credit schemes for one specific technology are offered, e.g. for a solar home system.

Microfinance splits the often relatively high initial investment costs into smaller monthly rates. This can make an energy project affordable. But do not forget that you also have to pay an interest on the borrowed money. The interest rates of MFIs vary broadly. If you want to finance your intended project by a loan from a MFI, compare the credit conditions and interest rates of nearby MFIs. To find out if the project is rentable for you, you have to include the capital costs in your calculations with the methods of capital budgeting (see above). That means you have to add the annual interest to the costs for the period of time until the loan is paid back.

Case Studies

- Business Plan for Solar Processing of Tomatoes

- Enabling PV in the MENA Region (in Tunisia)

- 2nd Powering Agriculture Call for Innovation to support groundbreaking technologies and business models within the energy/agriculture nexus for emerging markets and developing countries where many farmers and agribusinesses lack access to reliable, affordable and clean energy services.

Conclusion

- A business model describes the core strategy of an organization for how to gain money. For defining the key elements of your business model, it is recommended to carry out a detailed market analysis.

- The total costs of a project can be divided into capital expenditures (CAPEX) and operating expenses (OPEX), whereby latter can be subdivided into fixed and variable cost.

- The method of Capital Budgeting (e.g. Payback Period, NPV and IRR as the most common ones) helps to ascertain the profitability of planned projects.

- The services of microfinance (e.g. microcredits) can help low income households to finance small-scale energy projects.

Further Reading

- Reader of the MOOC "Powering Agriculture - Sustainable Energy for Food"

- An interesting study about a three continent comparison of microfinance for energy service was prepared by The SEEO Network: Link

- FAO (Food and Agriculture Organisation of the United Nations) prepared a paper about Guidelines and Case Studies for Microfinance in Fisheries and Aquaculture: Link

- Microfinance and forest-based small-scale enterprises: Link

- Energypedia Financing and Funding Portal

- Watch the MOOC expert video with Katie Kennedy Freeman from the World Bank: Link

- SNV Publication: Innovative Finance For Renewable Energy Solutions

- Business Models for Solar-Based Rural Electrification

References

- Reader of the MOOC "Powering Agriculture - Sustainable Energy for Food"

- FAO, 1995: FAO Fisheries Technical Paper – 351

- Osterwalder, A. 2010. What is a Business Model?

- HCC. 2009. Lecture 6 Capital Investment and Operational Costs.

- Rudolf, S. 2008. The Net Present Value Rule in Comparison to the Payback and Internal Rate of Return Methods