Fossil Fuel Resources in Kenya

Overview

As of 2007, Kenya spent over 40% of its foreign exchange earnings on importing crude oil and other petroleum products. This expense increases every year. The leading marketing company in Kenya is the Shell / BP Alliance with over 30% of the market share. The other companies involved are, Oil libya, Caltex, Total, Engen, Kobil / Kenya Oil Company (KENOL) and the state-owned National Oil Corporation of Kenya (NOCK).

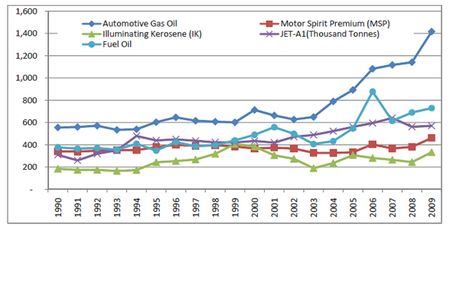

The figure below depicts the trends in fossil fuel consumption in Kenya[1]:

Fossil Fuels Potential and Distribution

Total petroleum consumption in Kenya has grown from 2.6 million cubic meters in 2003 to 3.73 million cubic meters in 2006.

As of 2007, Kenya had one refinery, the Mombassa refinery, with a nameplate capacity of 90,000 barrels per day. Since its commission the refinery has not operated at full capacity. There are storage facilities throughout the country and these are adequate for both crude and finished products. Distribution infrastructure consists of road, rail and pipeline systems. Kenya Pipeline Company (KPC) manages and owns the existing Mombassa-Nairobi pipeline. There is a second pipeline that extends from Eldoret to Kisumu in the west of the country.

Petroleum exploration in Kenya begun in the 1950’s with the first well being drilled in 1960. In 1986, the petroleum exploration and production legislation in Kenya was revised to provide suitable incentives and flexibility to attract international exploration interest in the country

The National Oil Company of Kenya (NOCK) has made 17 blocks available for petroleum rights negotiations. There are 4 prospective petroleum basins in Kenya, the Anza Graben, the Mandera Basin, and the Lamu Embayment. The blocks are mainly onshore with the exception of the Southern Lamu Embayment, which offers both onshore and offshore blocks. About 30 exploration wells have been drilled to date and although none has encountered a commercial discovery, a number of drill stem tests have recovered or tested gas. However, if Kenya found oil, it could take 4-7 years before the country could benefit from the possible insulation effect from a surge in global oil prices.

As of 2007, Kenya has no system for increasing the volume of oil imports or storing them in the wake of an oil supply disaster. However, the Energy Act, enacted on July 1st 2007, requires the Ministry of Energy to institute modalities for creating strategic stocks. The increasing dependence on imported oil makes the country economically vulnerable to energy terrorism.

In 2012, the Ministry of Energy announced that vast oil resources had been discovered in Turkana region of North Western Kenya. A company, Tullow Oil is currently evaluating the economic feasibility of the site.

► Kenya Energy Situation - Fossil_Fuels

Liquid Petrolium Gas (LPG)

Consumption ofhas increased by about 59% between 2003-2008 from 40,000 to 80,000 metric tons/year. The Kenya Petroleum Refinery makes about 30,000 metric tons of LPG and to balance growing demand reliance on imported LPG has increased. However, there are plans underway to upgrade the refinery to make 115,000 metric tons of LPG.

The government has removed import taxes from LPG cylinders from August 2006 and this will make it cheaper for consumers to acquire cylinders. It is also expected that the government will also remove VAT from cylinders. Previously the government had removed all taxes from the LPG product.

The Government is expected to construct the liquefied petroleum gas (LPG) handling facility in Mombasa to boost LPG supply to the country and the Great Lakes region and to commence a public private partnership to construct an inland depot and LPG distribution and filling depots in Athi river, Eldoret, Nakuru, Kisumu and Sagana to be completed by June 2010.

This will make the product more available to the all corners of the country. Concurrently, the industry-government efforts to harmonize cylinder sizes and also to standardize regulators and valves are on course.

Coal

The Ministry of Energy has identified two areas with possible commercially exploitable quantities of coal. These are the Mui basin of Kitui and Mwingi Districts and Taru basin of Kwale and Kilifi Districts. As of 2007, 10 wells have been drilled in Mui basin with encouraging results indicating possible existence of commercial quantities of coal. The samples from this basin compare very well with those (sub-bituminous) being used for power generation in South Africa.

In view of these results, the Ministry is fast-tracking the coal evaluation and reserve estimation process.

Challenges / Issues Affecting Exploitation of Fossil Fuels in Kenya

- Un-coordinated regulatory approach - the prevailing legal and regulatory framework is inadequate to oversee a smooth and efficient administration of the petroleum industry. The Restrictive Trade Practices, Monopolies and Price Control Act (CAP 504, Laws of Kenya) need to be reviewed to enable the Monopolies Commission to curb uncompetitive trade practices in the petroleum sector.

- Lack of a supportive & enabling environment leading to, product dumping, product adulteration, and illegal, sub-standard fuel sites - There is need to institutionalize functions of the free market to promote standards and effective regulation in the petroleum industry.

Further Information

References

- GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: II - Energy Resource.

- ↑ KIPPRA, 2010